Forget Stock Picking: Why Smart Investors Are Choosing Index Funds Instead

Your Blueprint to Consistent Gains Without Gambling on Individual Stocks

Get Joe Money Right is an email newsletter dedicated to helping the average Joe master their money. Some installments are free, others are for paid subscribers only. Sign up here:

Let’s be real: chasing individual stocks might feel thrilling, but it's usually a losing game for us everyday investors. The truth is simple—your best shot at growing wealth isn't betting on volatile stocks; it's trusting the steady, reliable power of broadly diversified index funds. In this post, we’ll break down exactly why stock picking often leads to disappointment and why index funds consistently deliver better results for your hard-earned cash. We’ll back it up with data from top-notch resources like the SPIVA Scorecard, insights from the DALBAR Report, and wisdom from legendary investors like Warren Buffett, John Bogle, and Burton Malkiel. Let’s dig in, and remember: we’re cutting through the fluff of mainstream financial advice to give you the real deal.

Table of Contents

Counterarguments: When (If Ever) Is Stock Picking Appropriate?

Final Verdict: Why Index Funds Are Your Best Bet for Building Wealth

The Average Joe’s Investment Dilemma

Imagine you’re at a local bar after work. Your buddies are chatting about some “hot stock” they heard about on the news. The conversation quickly turns into a debate about which stocks will make you rich. In that moment, it might seem like buying a few individual stocks is a smart idea—until you realize how risky it actually is. Here’s why:

Lack of Diversification: When you pick a few stocks, you’re betting on a handful of companies instead of the entire market. That means if one of those companies stumbles, your entire portfolio takes a hit. It’s like betting your paycheck on a three-legged horse in a race.

Behavioral Pitfalls: Emotional decisions, overconfidence, and impulsive trading are part and parcel of stock picking. As numerous studies have shown, even experienced investors often buy high and sell low, locked into a vicious cycle fueled by fear and greed.

The Data Doesn’t Lie: Extensive research consistently demonstrates that the vast majority of active stock pickers underperform simple, low-cost index funds. In fact, professional investors with all the fancy tools and teams often can’t beat the market averages—and neither can you, dear reader.

Now that we’ve set the stage, let’s get into the nitty-gritty of why index funds are the smarter path to building real wealth.

The Pitfalls of Stock Picking

1. Diversification: Avoiding the “All Eggs in One Basket” Trap

When you invest in individual stocks, you’re essentially putting your money on a few horses in a very competitive race. Most average investors hold only 3 to 4 stocks in their portfolios—hardly enough to spread out the risk. Research from industry experts like Goetzmann & Kumar shows that a diversified portfolio dramatically reduces the chances that one poor-performing stock will wreck your entire investment.

Concentrated Risk: If one of your chosen stocks tanks, you’re exposed to that company’s specific risk. In contrast, a broad index fund, such as one tracking the S&P 500, contains hundreds of stocks. That means even if a few falter, the overall impact on your investment is minimized.

Skewed Returns: Did you know that roughly 4% of the stocks account for most of the market gains? Studies, like the one by Hendrik Bessembinder, highlight that about 96% of stocks contribute little to net wealth creation in the market. This means if you pick the wrong stock, you miss out on the magic that only a diversified market can deliver. Learn more about these findings in Bessembinder’s paper.

2. Behavioral Biases That Cost You Money

Let’s be honest, even the most well-intentioned investors can fall prey to human psychology. Here are some of the major pitfalls:

Overconfidence: Many investors think they have a unique edge when picking stocks. Studies by Barber and Odean reveal that overconfident investors trade excessively—leading to lower returns. Simply put, the more you trade, the more you lose when fees and mistakes add up.

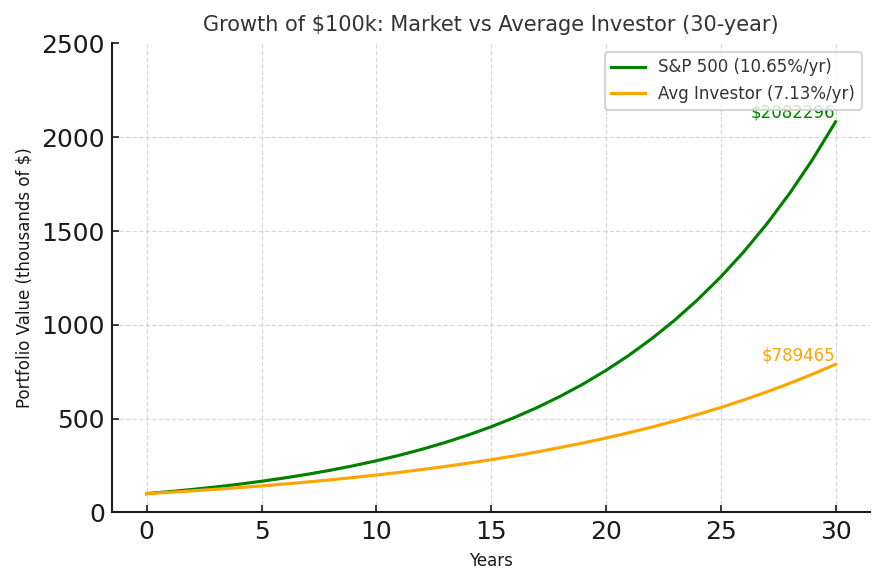

Emotional Trading: Fear and greed are constant companions in the stock market. Research from the DALBAR Report consistently shows that the average investor ends up earning much less than the market because of poor timing and emotional decisions. For instance, while the S&P 500 might return around 10% annually over the long term, individual investors might only see 3.7% because they sell in panic and buy in euphoria.

The Disposition Effect: It’s all too common to hold onto losing stocks for too long while cashing in on winners too quickly. This behavior, known as the disposition effect, undermines your potential gains. By contrast, a disciplined strategy of investing in an index fund ensures you stay the course, even when the market takes a dip.

The evidence is clear, and the numbers don’t lie—emotional trading and behavioral biases cost the average investor dearly.

3. Underperformance Relative to the Market

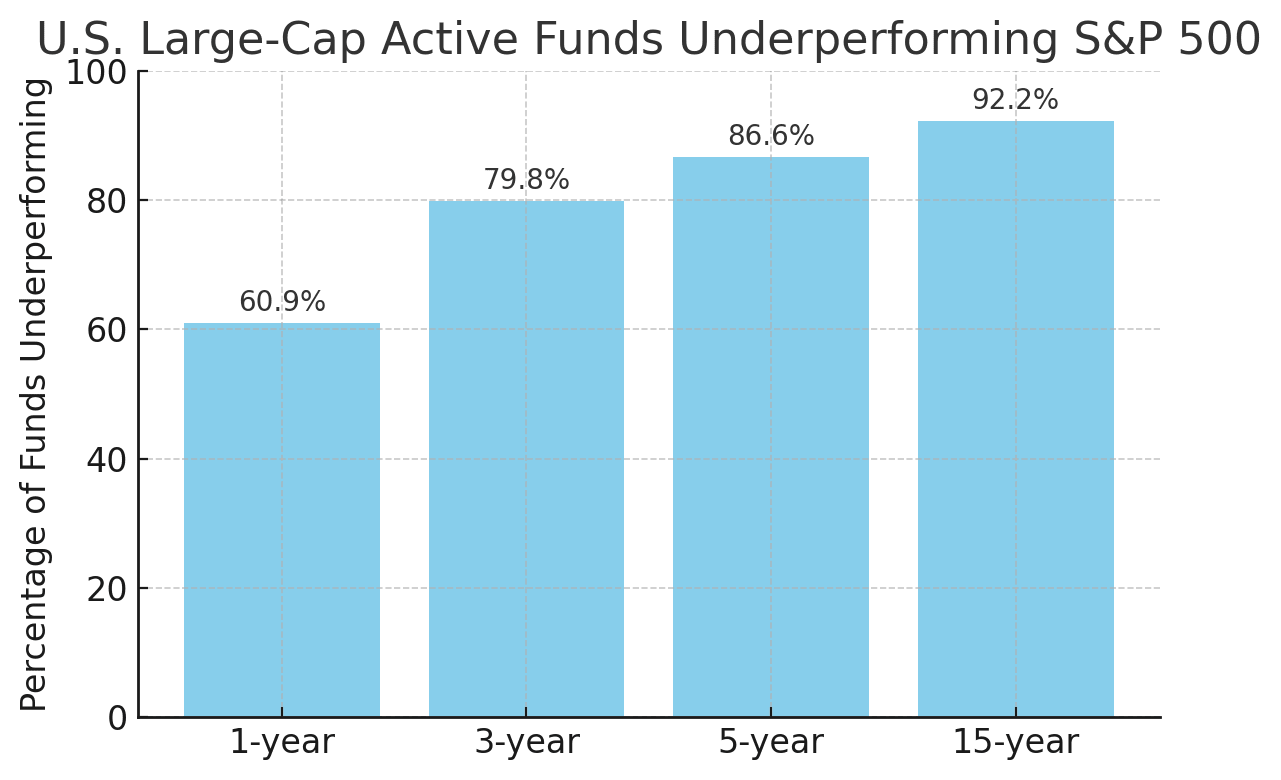

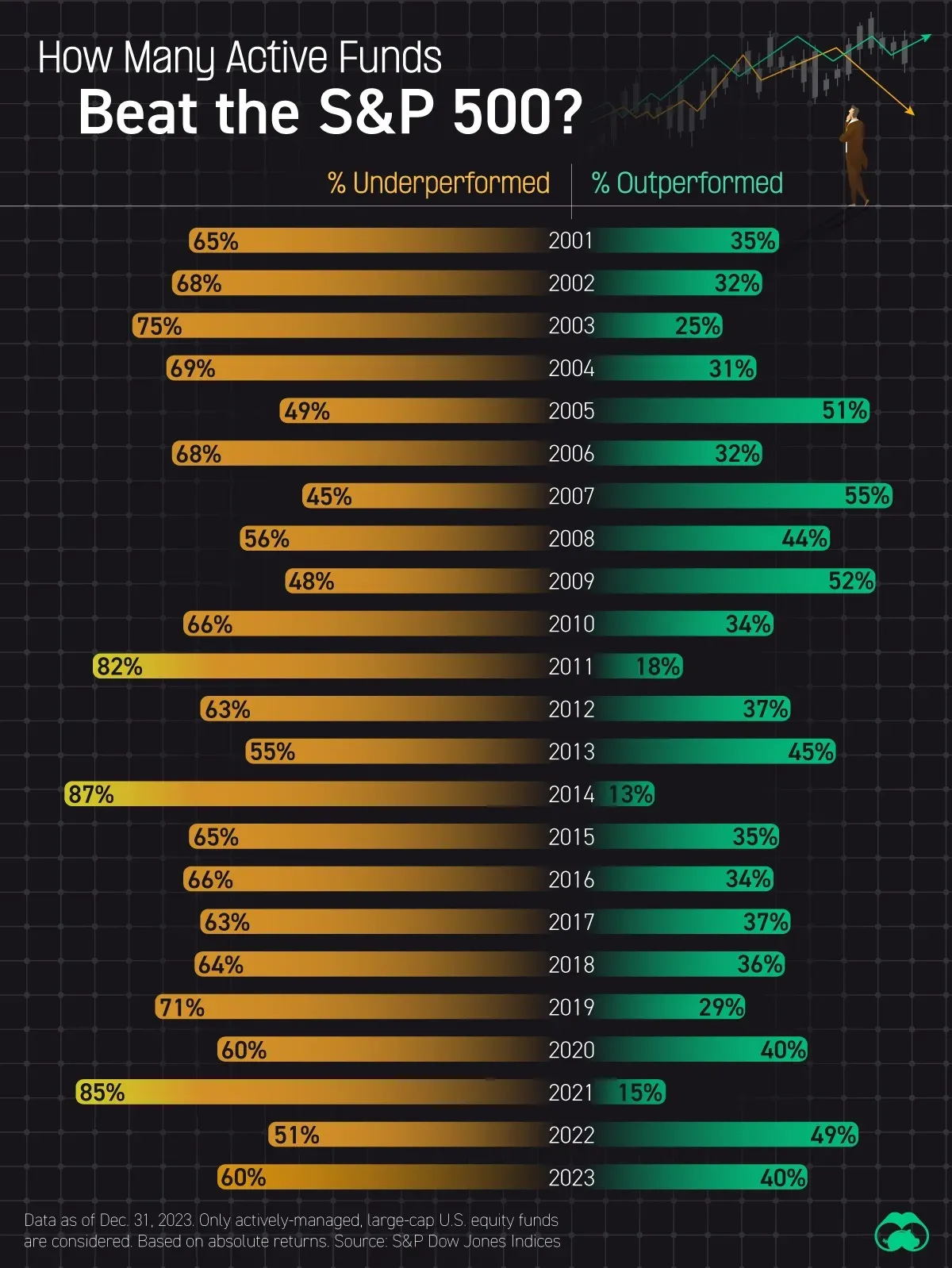

Even if you manage to pick a few winners, the odds are stacked against you in the long run. Data from the SPIVA Scorecard shows that a majority of actively managed funds underperform their benchmark indexes year after year. Here’s what the numbers say:

Yearly Underperformance: Most active funds, even those managed by professionals, fail to beat their benchmarks on an annual basis. Over a 5-year period, the underperformance rate climbs even higher.

Long-Term Results: Over a 15-year stretch, more than 90% of large-cap funds fall short of the index’s return. This means that if you want to see your money grow, you’re better off investing in a low-cost index fund that mirrors the entire market.

Even legendary investors like Warren Buffett have admitted that for the average person, trying to beat the market through stock picking is a fool’s errand. Buffett himself has long championed the idea of investing in the S&P 500 index fund, which has historically outperformed the average active trader after fees and mistakes are factored in.

4. The Time and Expertise Investment

Let’s face it—successful stock picking isn’t for the faint of heart. It requires hours upon hours of research, staying updated with every quarterly earnings report, and a deep understanding of each company’s fundamentals. Do you have the time and expertise to commit to that level of diligence? Probably not, and that’s totally okay.

Professional Edge: Institutional investors and professional fund managers spend countless hours and resources analyzing companies. They have access to proprietary data, research tools, and analytical teams. For most of us, the time required to compete is simply not available.

Continuous Monitoring: Stock picking isn’t a “set it and forget it” strategy. It’s a dynamic process requiring constant vigilance. Missing an important news update or misjudging market sentiment can spell disaster. With index funds, your investment follows a predefined strategy without requiring daily (or even monthly) tweaks.

5. Poor Risk-Adjusted Returns

Even if you manage to match the market’s raw returns with a few well-chosen stocks, your portfolio’s volatility will be much higher than that of a diversified index fund. This is why professionals often evaluate investments based on risk-adjusted returns, which take into account both the return and the level of risk assumed.

High Volatility: A concentrated stock portfolio might yield high returns during a bull market, but it also carries significant volatility. One bad earnings report or unforeseen crisis can lead to dramatic losses that a broad index would absorb more gracefully.

Sharpe Ratio: The Sharpe ratio—a measure of risk-adjusted return—tends to favor well-diversified investments. Index funds typically offer smoother returns with lower volatility, which, when adjusted for risk, often means you’re getting a better deal.

By choosing index funds, you’re not only chasing a competitive return, but you’re also minimizing the risk that could derail your financial future.

The Case for Index Funds: A Smart, Simple Strategy

Now that we’ve laid out the pitfalls of individual stock picking, let’s talk about why index funds are the unsung heroes of smart investing. This isn’t just about playing it safe—it’s about playing the long game, and here’s why index funds win:

1. Automatic Diversification: Owning the Entire Market

With an index fund, you’re not picking winners and losers—you own the entire market (or a broad slice of it). Whether it’s an S&P 500 fund, a total stock market fund, or even a global index fund, you’re getting exposure to hundreds or thousands of stocks.

Instant Risk Management: Diversification is the best defense against individual stock volatility. When one stock underperforms, another might outperform, balancing your overall return.

Holistic Growth: A broad index fund captures the growth of the entire economy. Instead of worrying about the next poor earnings report, you simply benefit from the overall upward trend in the market.

For more on diversification benefits, check out this article on diversification strategies.

2. Low Costs: Keeping More of Your Money

One of the biggest reasons to choose index funds is their low cost. Active management comes at a steep price—management fees, trading costs, and a slew of other expenses that eat into your returns.

Expense Ratios: Many index funds have expense ratios as low as 0.03% to 0.1%, compared to the 0.5% to over 1% that active funds charge. Over time, lower fees mean more money compounding in your portfolio.

Fewer Transactions: Since index funds track a preset basket of stocks, they incur minimal trading costs and generate fewer taxable events. The Morningstar Data show that these cost savings can add up significantly over the long term.

3. Tax Efficiency: Keeping Uncle Sam at Bay

Tax efficiency is often an unsung benefit of index funds. Because they typically have low turnover—meaning they don’t constantly buy and sell stocks—they produce fewer taxable capital gains compared to actively managed funds.

Fewer Taxable Events: With lower turnover, index funds don’t force you to realize taxable gains every year. That means your money stays invested and continues to grow.

ETFs and Tax Structure: Many index funds are structured as ETFs, which offer additional tax advantages. Their unique creation and redemption process helps avoid triggering capital gains.

For a deeper dive, you might want to read about Fidelity’s take on tax-efficient investing.

4. Simplicity and Peace of Mind

Index funds are as straightforward as it gets. You don’t need a PhD in finance or a Wall Street connection to invest in them. They offer a “set it and forget it” approach, which is perfect if you’re busy living your life rather than micromanaging your investments.

Hands-Off Investing: Once you buy an index fund, there’s no need to constantly check the market. You’re riding the long-term growth of the economy.

Less Emotional Trading: Since you’re not picking individual stocks, you’re less likely to fall prey to the emotional roller coaster of market fluctuations. This reduces the temptation to trade impulsively and helps you stick to your long-term plan.

5. Consistent Long-Term Performance

When you look at decades of market data, index funds have consistently outperformed the average actively managed portfolio. For example, Warren Buffett himself has often pointed out that the majority of investors will be better off with an S&P 500 index fund rather than trying to beat the market with individual stock picks.

Reliable Returns: While active managers might have occasional wins, statistically, the SPIVA Scorecard shows that over a 15-year period, more than 90% of them fall short of the benchmark.

Compounding Benefits: Over the long term, the combination of low fees, diversification, and tax efficiency can lead to significantly higher wealth accumulation.

Making Sense of the Numbers: Evidence That Indexing Wins

If you’re still on the fence, let’s take a closer look at the research. Here’s the data that drives home the point:

SPIVA Scorecard

The SPIVA Scorecard is a must-read for anyone interested in the performance of active versus passive investing. It consistently shows that the vast majority of active funds don’t beat their benchmark. Imagine this: over a typical 5-year period, about 86% of large-cap funds underperform the S&P 500. Over 15 years? More than 90% underperform. This isn’t a fluke—it’s the reality of the market.

DALBAR Reports

The DALBAR Report drives home the message even further. It reveals that the average investor, bogged down by emotional decisions and poor timing, earns a fraction of what the market returns over the long haul. In some reports, the market might return around 10% per year, yet the average investor sees only about 3.7% because of losses from panic selling and buying high. That’s a staggering difference that translates into a massive wealth gap over decades.

Academic and Professional Research

Studies by researchers like Barber and Odean explain why excessive trading driven by overconfidence leads to lower returns. And studies from academic heavyweights such as the work by Hendrik Bessembinder underscore that a tiny fraction of stocks drives overall market gains. In plain language, unless you have insider-level acumen (which, for most of us, we don’t), betting on individual stocks is a roll of the dice.

Wisdom from the Legends

Warren Buffett: The Oracle of Omaha has continuously stressed that for most people, investing in the S&P 500 index fund is the smartest move. He’s even wagered his fortune against professional stock pickers, and guess who won?

John Bogle: The founder of Vanguard preached the gospel of index investing for years, urging investors to “buy the haystack, not just the needle.” His approach has empowered millions of investors to safeguard their savings while capturing the full spectrum of market gains.

Burton Malkiel: The author of A Random Walk Down Wall Street argued that even a blindfolded monkey could pick a portfolio as good as the ones managed by professionals. While his statement is tongue-in-cheek, the underlying message is crystal clear: beating the market isn’t as simple as it sounds.

Each of these voices echoes the same sentiment: for the ordinary investor, the simplest way to invest is to mimic the market’s performance—not try to outsmart it.

Counterarguments: When (If Ever) Is Stock Picking Appropriate?

Now, before you completely shut down the idea of picking a few stocks on your own, let’s entertain some counterarguments. There are scenarios where a savvy investor might consider dipping into individual stocks—but for most of us, these exceptions are just that… exceptions.

“Fun Money” and a Side Hustle in Investing

Some investors enjoy the thrill of stock picking and are willing to set aside a small portion of their portfolio for that purpose. Think of it as “fun money.” While there’s nothing inherently wrong with this approach, it should only constitute a minor part of your overall investment strategy. The majority of your wealth should be tied up in diversified, low-cost index funds to safeguard your financial future.

Specialized Knowledge and Niche Markets

There are markets and sectors that aren’t as efficiently priced as the massive U.S. large-cap stocks. If you have specialized knowledge—say, you work in biotech or technology—you might have insights that could give you an edge. Even so, remember that time and expertise are required, and the odds are still heavily stacked against you. For most of us, it’s far more reliable to stick with index funds and let the experts in those niches do their thing.

Active Management for Downside Protection

Some advocates argue that active stock picking can offer downside protection during market downturns. The idea is that a skilled manager can shift focus away from high-risk stocks during tough times, cushioning the fall. While this works occasionally, the track record shows that very few managers can consistently time the market. More often than not, the cost and risk of active management overshadow any potential benefits.

Pride and Ownership

At the end of the day, some investors just want to own a piece of the companies they believe in. Whether it’s a local business or a company they admire, there’s an emotional pull to owning something tangible. While this can be satisfying from a personal standpoint, it’s important to remember that your portfolio’s health should be your first priority. If you choose to indulge in this approach, keep it to a small percentage of your overall investments and don’t let sentiment cloud your financial judgment.

Final Verdict: Why Index Funds Are Your Best Bet for Building Wealth

It’s time to cut through the noise. The evidence is overwhelmingly in favor of index funds as the best way to build long-term wealth, especially for the everyday investor. When you choose index funds, you get:

Built-in Diversification: No need to worry about picking the wrong stocks. You own a slice of the entire market.

Low Costs: Minimal fees mean more of your money stays invested and compounds over time.

Tax Efficiency: With fewer taxable events, you keep more of your gains.

Ease and Simplicity: A set-it-and-forget-it strategy that saves time and removes emotional decisions from your investing process.

Consistent Long-Term Returns: Historical data shows index funds reliably outperform the majority of actively managed portfolios.

This is not a call to be bland or to settle for average returns. It’s a call to be smart. It’s a call to refuse the temptation to chase the latest market fads or hot tips. The truth is, if you’re an average Joe without a dedicated team of analysts or the time to chase every market trend, your best bet is to invest in index funds.

Imagine explaining this at that local bar: while some fancy Wall Street types are scrambling to guess which individual stock will be the next big thing, you’re sitting back with a diversified portfolio that’s practically guaranteed to grow steadily over time. It’s not about missing out on the excitement—it’s about safeguarding your financial future, reducing risk, and ultimately, growing your money in a way that makes sense.

Practical Steps to Get Started with Index Investing

Ready to take control of your financial future? Here are some actionable steps to start investing in index funds:

Educate Yourself: Spend some time understanding what index funds are and how they work. The Vanguard Index Funds page is a fantastic resource for beginners.

Choose Your Index: Decide whether you want to invest in a U.S. index fund like the S&P 500, a total market fund, or even a global index fund. Think about your risk tolerance and investment goals.

Set Up an Account: Open an investment account with a low-cost brokerage that offers index funds with minimal fees. Brokerages like Vanguard, Fidelity, and Schwab offer excellent options.

Automate Your Investments: Take advantage of automatic investment plans. This “set it and forget it” method not only saves time but also removes the temptation to try and time the market.

Stay the Course: Remember, investing isn’t about overnight riches. It’s about consistent, long-term growth. Don’t get swayed by short-term market noise. Stick with your index fund, keep investing regularly, and let the magic of compounding work for you.

Wrapping It Up: Don’t Get Played by the Market

Let’s face it: the world of investing can be brutal to those who try to go it alone and pick individual stocks. For most of us, trying to beat the market is like trying to find the proverbial needle in a haystack—an endeavor that sounds romantic but is fraught with peril. The evidence—from the SPIVA Scorecard to the DALBAR Report and the insights of investment legends like Warren Buffett and John Bogle—shows that for the average investor, the smart play is simple.

Stop attempting to time the market and select the elusive winning stock. Instead, invest in a diversified index fund, remain patient, and allow the market to perform naturally. This approach is not merely about safety; it is about ensuring you are among the few investors who are not adversely affected by costly mistakes and exaggerated hype. It represents a strategic move away from the conventional wisdom that has consistently promoted risky investment tactics.

The bottom line is clear: if you’re serious about growing your wealth and keeping your hard-earned cash safe, ditch the risky individual stock bets. Embrace the power of index funds, and join the ranks of savvy investors who know that sometimes, less really is more.

Resource Round-Up

For more detailed research and further reading, here’s a list of some essential resources mentioned in this post:

SPIVA Scorecard: A comprehensive report detailing the performance of active funds versus their benchmarks.

DALBAR Report: In-depth analyses showing the detrimental effects of emotional investing and trading mistakes.

Warren Buffett Letters: Annual shareholder letters from one of the world’s greatest investors, explaining why index funds are a smart choice.

Vanguard’s Guide to Index Funds: An excellent resource for understanding the basics and benefits of index investing.

Barber and Odean Study on Trading: A seminal paper on the impact of excessive trading on investor returns.

Bessembinder’s Research: Academic research explaining why only a small fraction of stocks drive market gains.

Morningstar Data: Insights into fund performance, fees, and the cost advantages of low-cost index funds.

Fidelity’s Insights on Tax-Efficient Investing: Learn how index funds can minimize taxable events and enhance overall returns.

Final Thoughts: Play It Smart, Play It Safe

Ultimately, this is about safeguarding your financial future—the everyday investor who deserves a solid, reliable investment strategy. You need an approach that consistently performs, keeps costs low, and sidesteps the common emotional pitfalls.

Choosing index funds is not just about making a wise decision; it is about positioning yourself for financial success in a way that most actively managed portfolios simply cannot replicate. It is time to move beyond the gamble of stock picking and adopt a proven strategy embraced by successful investors for generations.

If you are ready to silence the noise and start effectively growing your wealth, now is the moment to act. Embrace the simplicity and power of the market through index funds and allow them to guide you towards sustained, long-term prosperity. After all, as smart investors have known for decades, if you cannot beat them, join them—and watch your wealth steadily grow.

Now go out there, set up your investment account, and let the market work its magic for you. Don’t miss out—your future self will thank you.

Want more insights like this delivered straight to your inbox? Subscribe to Get Joe Money Right and never miss a post! Each week, I break down investing, wealth-building, and financial strategies in a way that makes sense for everyday people like you and me. The smart money moves fast—make sure you're staying ahead of the game.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.