The Ultimate Guide to Portfolio Margin: Unlocking More Trading Power

How Regular Investors Can Safely Leverage Risk-Based Margin for Bigger Gains

Get Joe Money Right is an email newsletter dedicated to helping the average Joe master their money. Some installments are free, others are for paid subscribers only. Sign up here:

Portfolio margin can feel like Wall Street’s best-kept secret—promising everyday traders more power, flexibility, and efficiency in their investing strategy. But what exactly is portfolio margin, and how does it differ from the standard "Reg T" margin most of us know? As an average Joe who's navigated the ups and downs of advanced retail trading, I’m here to break it down in simple, relatable terms. In this guide, I'll walk you through how portfolio margin works, its unique benefits and risks, and whether it's right for your investing journey. Buckle up—this could be the trading edge you've been looking for.

Table of Contents

What Is Portfolio Margin and How Does It Differ From Reg T Margin?

How Portfolio Margin Works: Risk Models and Margin Calculation

Portfolio Margin in Action: Use Cases and Strategy Implications

What Is Portfolio Margin and How Does It Differ From Reg T Margin?

Portfolio Margin vs. Reg T Margin: The Basics

In my early trading days, I used to think all margin was created equal—until I discovered the difference between Regulation T (Reg T) margin and portfolio margin. In the simplest terms:

Reg T Margin: This is the standard margin system that most brokers use. It requires you to put up a fixed percentage of the total value of your trades—typically 50% initial margin for buying stocks. Think of it as the “one size fits all” rule that doesn’t change much regardless of what you’re trading.

Portfolio Margin: Now, here’s where things get interesting. Portfolio margin is a risk-based margining system. Instead of using one-size-fits-all percentages, it calculates margin requirements based on the overall risk of your entire portfolio. This means it recognizes that not all trades are created equal—hedged or diversified positions, for instance, might require far less margin. This system is designed to free up your capital and let you trade with greater leverage, but it also comes with a heightened risk profile.

Curious about the technical details? Check out the FINRA regulations and Interactive Brokers’ margin requirements to see how these numbers come into play.

My Personal Journey With Portfolio Margin

I remember the first time I switched to a portfolio margin account—it felt like stepping into a high-performance sports car. Suddenly, the amount of buying power I had was significantly increased, and I could deploy sophisticated strategies that I’d only read about before. However, as I quickly learned, with great power comes great responsibility. The extra leverage meant that any miscalculation could wipe out your gains in a flash. In the following sections, I’ll explain exactly how portfolio margin works, the regulatory framework behind it, and the real risks and benefits you need to know.

The Regulatory Framework Behind Portfolio Margin

U.S. Regulations: FINRA, SEC, and Rule 4210

In the U.S., portfolio margin isn’t just some broker’s creative idea—it’s governed by strict rules set out by FINRA and the SEC. One key regulation is FINRA Rule 4210, which was updated to allow a risk-based margining system like portfolio margin. This rule ensures that the margin requirements truly reflect the potential risk of the positions in your portfolio.

For example, while Reg T requires a flat 50% margin on a stock purchase, portfolio margin calculates the potential loss in a worst-case scenario—say, a 15% drop for a well-hedged stock position. This can mean significantly lower margin requirements if your portfolio is diversified. To dive deeper, check out the SEC’s guidelines and detailed broker disclosures on portfolio margining.

Eligibility and Broker-Specific Rules

Not everyone can just flip a switch and start trading on portfolio margin. Here are some eligibility details:

Account Minimums: Most brokers require a minimum equity of $100,000 or more. For instance, Interactive Brokers typically demands at least $110,000, while Schwab and (formerly TD Ameritrade) require around $125,000.

Experience Requirements: You usually need to have some level of options trading approval (often Level 3 for uncovered options) and a good understanding of how margin works.

Broker Policies: Each broker has its own quirks. For example, Interactive Brokers uses a system called TIMS (Theoretical Intermarket Margining System) to calculate margin. Schwab’s thinkorswim platform offers tools to simulate portfolio margin requirements, so you know exactly what you’re in for.

I remember the nerve-wracking moment when my broker sent me a warning as my equity dipped below the threshold. It was a real wake-up call—portfolio margin isn’t a free lunch. You have to be ready to either add cash or scale back your positions at a moment’s notice.

How Portfolio Margin Works: Risk Models and Margin Calculation

The Mechanics: TIMS and SPAN

When you’re using portfolio margin, your broker isn’t just pulling numbers out of thin air. They rely on sophisticated risk models such as TIMS (Theoretical Intermarket Margining System) for equities and options, and SPAN (Standard Portfolio Analysis of Risk) for futures. Here’s a quick breakdown:

TIMS: This model simulates worst-case scenarios by applying a range of market moves (usually around ±15% for individual stocks) and adjusts for changes in volatility. It calculates the potential loss on each position and then requires margin based on the worst-case outcome.

SPAN: Used primarily for futures, SPAN generates multiple risk scenarios to find the worst-case loss for the portfolio.

These models are designed to capture the real risk of your positions. For example, if you’re holding a long position in a stock, TIMS might show that a 15% drop would cost you a certain amount—and that becomes your margin requirement. Compare that to Reg T, where you’d simply be paying 50% of the total value regardless of actual risk.

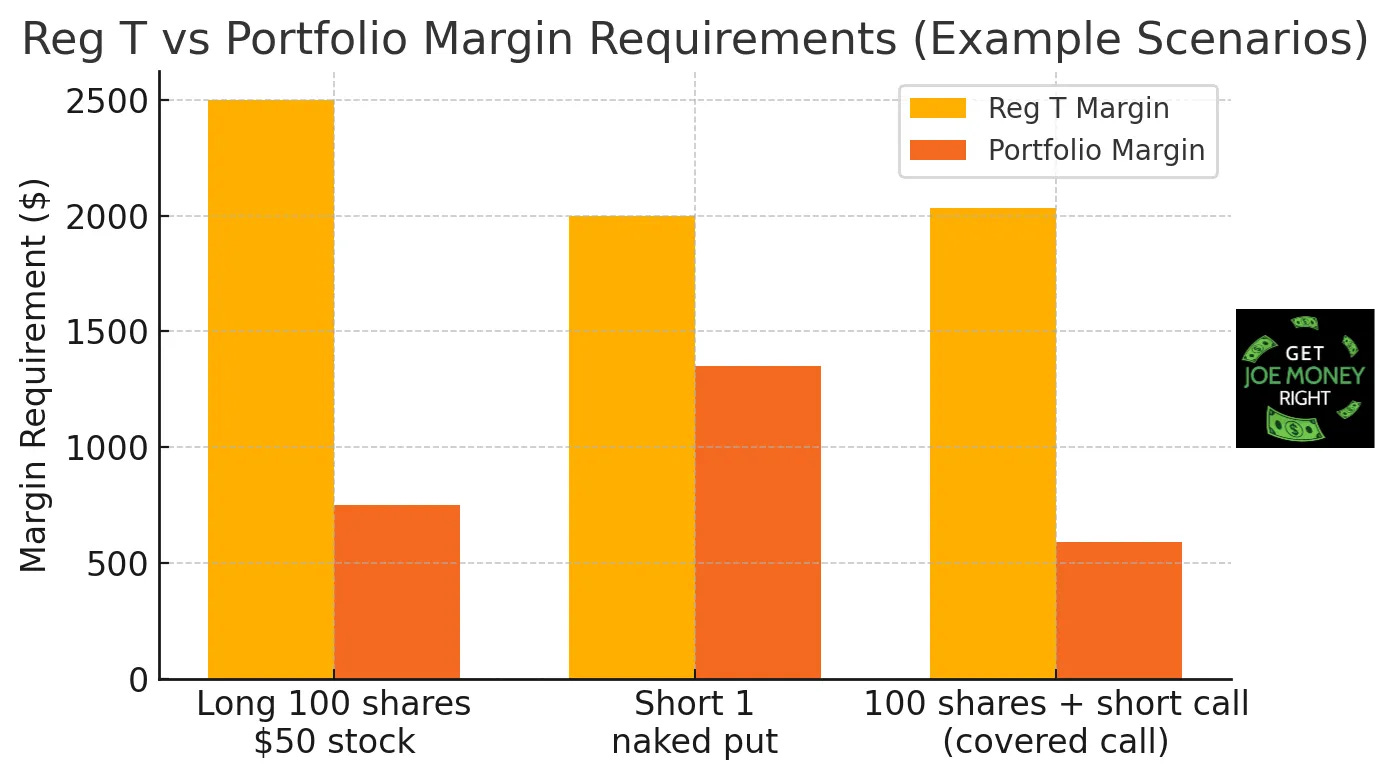

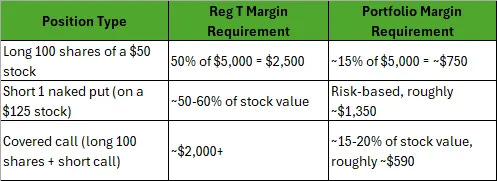

A Real-Life Comparison Table

To make things clearer, here’s a table that compares the margin requirements for some simple positions under Reg T and portfolio margin:

This table demonstrates that portfolio margin can significantly lower the capital you need to put up for the same trades, especially when your positions are hedged. For more details on how these calculations work, check out Interactive Brokers’ margin guidelines and related Schwab resources.

How Volatility, Correlation, and Portfolio Composition Affect Margin

The beauty of portfolio margin lies in its risk-based approach. Here’s what that means for your portfolio:

Volatility: Higher volatility increases the margin because the potential loss in a worst-case scenario is higher.

Correlation: If your investments are well-correlated (for example, long and short positions in the same sector), the system recognizes that losses in one position may be offset by gains in another, thus lowering the overall margin requirement.

Diversification: A diversified portfolio is considered less risky, so even if individual positions are volatile, the overall risk is spread out—resulting in lower margin.

I’ve learned this lesson the hard way. Once, I had a concentrated position in a volatile tech stock (TSLA), thinking that diversification wasn’t necessary. When the stock took a nosedive, my portfolio margin requirement spiked, and I got hit with a margin call. Lesson learned: Diversification isn’t just a buzzword—it’s a lifeline. Ray Dalio’s All Weather Portfolio is a great model to follow for achieving it.

Speaking of volatility, if you're not careful, it can completely wreck your account. Check out my deep dive on variance drain to learn how to protect yourself.

The Benefits and Risks of Portfolio Margin

The Upside: More Leverage and Greater Flexibility

One of the biggest draws of portfolio margin is its ability to give you more trading power. Here’s why savvy investors love it:

Higher Leverage: With portfolio margin, you can often get 6 to 7 times the buying power compared to Reg T’s 2:1 leverage. This means more potential for profits if you play your cards right.

Lower Margin on Hedged Positions: If you have offsetting positions (like a long stock paired with a protective put), the margin requirement drops because the risk is lower.

Flexibility for Complex Strategies: Advanced options strategies like iron condors, spreads, or market-neutral trades benefit hugely from portfolio margin because the system recognizes the offsetting risks.

Imagine being able to trade with the buying power of a professional trader, all while keeping your actual cash outlay much lower. That’s what portfolio margin can do—provided you know what you’re doing. As I experienced, the boost in buying power can be a double-edged sword. It’s exhilarating to see your account “stretch” further, but it also means that any misstep can be magnified.

The Downside: Amplified Losses and Margin Calls

While portfolio margin offers the potential for higher returns, it also exposes you to higher risks:

Amplified Losses: Because you’re using more leverage, losses can mount quickly if the market moves against you. A small market downturn could wipe out your equity much faster than in a Reg T account.

Volatile Margin Requirements: Unlike Reg T’s static percentages, portfolio margin is recalculated continuously. This means that in volatile markets, your margin requirement can suddenly spike, leading to unexpected margin calls.

Risk of Rapid Liquidation: If you’re unable to meet a margin call, your broker may liquidate your positions in a flash, potentially at a loss. This is particularly dangerous in fast-moving markets.

Complexity: The system is more complex, and understanding how your margin is calculated requires a deeper knowledge of risk management.

I’ve had my fair share of nail-biting moments when market volatility forced a rapid increase in my margin requirement. It felt like riding a roller coaster without a seatbelt—thrilling until you realize that one wrong move could have you forced out of your position.

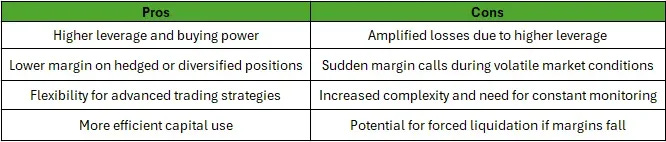

A Quick Look: Pros vs. Cons

Below is a summary table that encapsulates the benefits and risks of portfolio margin:

For more insights on these trade-offs, you can read detailed discussions on FINRA’s website or check out the Interactive Brokers margin page.

Portfolio Margin in Action: Use Cases and Strategy Implications

Options Trading: A World of Opportunity

If you’re into options trading—like I was a few years back—portfolio margin is a revelation. It makes strategies like iron condors, straddles, and spreads much more capital efficient. For example, a short strangle on the S&P 500 might only require a margin based on the worst-case move in one direction, rather than the sum of both sides as in Reg T. This means you’re not unnecessarily tying up cash for positions that are naturally hedged.

In my early days of options trading, switching to portfolio margin meant I could deploy more sophisticated trades without needing a fat bank balance. I vividly remember the moment I realized that my hedged options spread only needed a fraction of the capital compared to what I was used to under Reg T. That extra capital let me diversify further, and it felt like I was finally playing on the same field as the pros.

Short Selling and Leveraged ETFs: Getting the Most Out of Down Moves

Another compelling use case is short selling. Under Reg T, shorting a stock requires a hefty margin—often over 150% of the stock’s value. Portfolio margin, however, calculates the requirement based on a risk model that might assume a 15% upward move on the stock, drastically reducing the margin needed.

For those of you who are bearish on certain stocks or ETFs, this is a big deal. I once tried shorting a stock I believed was overvalued. With portfolio margin, I was able to take a larger position than I would have otherwise, which amplified my gains when the stock eventually dipped. Just remember—this comes with increased risk if the stock unexpectedly surges.

Hedged Portfolios and Market-Neutral Strategies

Portfolio margin really shines for hedged portfolios. If you’re doing long/short trades, convertible arbitrage, or any market-neutral strategy, the system will calculate margin on the net risk rather than the gross position sizes. That means you could be long $1 million in one stock and short $1 million in another, and your margin requirement might be just the difference in risk, rather than the sum of both.

I’ve seen hedge funds and proprietary trading desks use these principles to create highly leveraged, market-neutral strategies that deliver consistent returns even in sideways markets. For an everyday investor looking to dip their toes into sophisticated strategies, this can be an attractive option—provided you understand the risks and have robust risk management in place.

A Real-World Example: A Day in the Life With Portfolio Margin

Imagine you’re an options trader with a diversified portfolio of stocks and options. Under Reg T, your buying power is capped at 2:1 leverage, meaning a $100,000 account can only handle $200,000 worth of positions. But with portfolio margin, if your positions are hedged well, that same $100,000 might support up to $600,000 in exposure.

I remember one particularly exciting day when the market was calm, and I had set up a series of hedged options spreads. My portfolio margin account showed only a modest margin requirement despite the large notional exposure. It was like having a secret pass that unlocked extra trading power. Of course, I kept a close eye on the market and maintained a strict stop-loss strategy, because if volatility spiked unexpectedly, that extra leverage can turn into a real liability—fast.

Real-World Data and Institutional Perspectives

How Portfolio Margin Stacks Up in Different Market Conditions

Let’s get into some numbers. In low-volatility environments—think of the bull market before 2020—portfolio margin can provide a huge advantage. A well-diversified equity portfolio might only require around 15% of its value as margin. This can translate to leverage of up to 6.7 times, compared to Reg T’s standard 2:1.

However, when market volatility skyrockets, like during the COVID-19 crash, portfolio margin requirements can spike dramatically. Suddenly, a portfolio that was leveraged 6.7 times might face margin calls that force a rapid reduction in positions. According to industry data from that period, some accounts saw their margin requirements double or even triple overnight. This isn’t to say portfolio margin is inherently risky—it’s just that it’s highly sensitive to market conditions. For more in-depth data, you can review reports from FINRA and Interactive Brokers’ research.

Institutional Use and Risk-Adjusted Returns

Big hedge funds and institutional traders have been using portfolio margin (or risk-based margin systems akin to it) for years. They appreciate that the system allows them to operate with lower capital requirements, thus increasing their return on equity. For example, a hedge fund might aim for a risk-adjusted return by leveraging their market-neutral strategy—if the portfolio margin model shows a 15% worst-case loss scenario on a diversified portfolio, they can leverage more aggressively than a trader stuck under Reg T’s rigid rules.

Institutions often stress-test their portfolios far beyond the broker’s margin calculations, sometimes preparing for market moves beyond the standard ±15% range. This extra layer of risk management is something that everyday investors should note: portfolio margin can be a double-edged sword if you’re not prepared for sudden volatility spikes. I’ve taken extra steps to simulate worst-case scenarios for my trades, and let me tell you, that proactive approach can save your portfolio when the market throws a curveball.

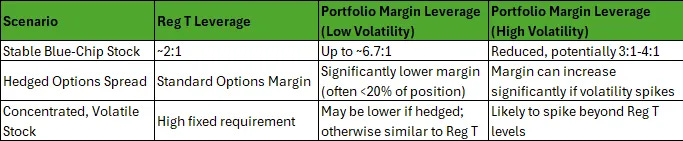

A Comparison Table: Portfolio Margin vs. Reg T in Different Scenarios

Below is a simple table to compare how margin requirements can change based on market conditions:

This table is a simplified illustration, but it shows how the environment can dramatically influence your buying power and risk. Always remember that while portfolio margin can unlock extra leverage, it requires you to be on your toes.

Wrapping It Up: Should You Go For Portfolio Margin?

Who Is Portfolio Margin For?

In my humble opinion, portfolio margin isn’t for everyone. If you’re an average investor who dabbles in buying and holding a few stocks, stick with Reg T. Portfolio margin really shines for those of us who are more active in the market—if you’re trading options, shorting stocks, or running complex, hedged strategies, then portfolio margin might be your ticket to more efficient capital use.

However, as with any tool that offers greater leverage, the risks are higher. It’s like being given a high-performance car—if you know how to drive it, you can enjoy a thrilling ride. But if you’re not careful, you might end up with a wreck. For more details on eligibility, check out Schwab’s portfolio margin guidelines, Interactive Brokers’ requirements, or this GREAT video explaining portfolio margin.

Key Takeaways for the Everyday Investor

Here are some crucial points I’ve learned from my journey:

Understand the Risks: Portfolio margin can give you more trading power, but if the market turns against you, losses are magnified. Always be prepared for margin calls.

Know Your Broker’s Rules: Each broker has its own requirements and safeguards. Make sure you’re comfortable with their policies before you switch.

Diversification is Your Friend: Don’t put all your eggs in one basket. A diversified portfolio is less likely to trigger extreme margin requirements.

Stress Test Your Portfolio: Regularly simulate worst-case scenarios. Knowing your potential losses can help you make smarter decisions.

Keep a Cash Cushion: Never use all your available buying power. Always leave a buffer for those inevitable market surprises.

Final Thoughts: My Two Cents

Switching to portfolio margin was a turning point in my trading career. It opened up new strategies and allowed me to better manage my capital. But it also taught me that there are no shortcuts in the world of investing—every benefit comes with a corresponding risk. I now always emphasize proper risk management, regular portfolio reviews, and a healthy dose of humility.

If you’re thinking about diving into portfolio margin, do your homework. Read up on the FINRA rules, talk to your broker about their specific requirements, and don’t be afraid to start small. As an average Joe who’s learned the hard way, I can tell you that while portfolio margin is a powerful tool, it’s only as good as your understanding of it and your discipline in using it.

So, are you ready to pounce on this opportunity and potentially boost your trading game? Don’t miss out—do your research, set up your account, and always trade smart. The market’s full of ups and downs, and with the right approach, portfolio margin might just be the edge you need in today’s fast-paced trading world.

Conclusion: Taking Control of Your Trading Destiny

To wrap things up, portfolio margin is an advanced margining system that offers a real edge for the savvy trader. It works by using risk-based models like TIMS and SPAN to calculate margin based on the overall risk of your portfolio—not just a fixed percentage as in Reg T margin. This can free up significant capital, especially if you employ hedging strategies or run a diversified, market-neutral portfolio. But remember, extra leverage comes with extra risk.

As I’ve learned on my trading journey, having portfolio margin is like having a powerful tool in your arsenal. Use it wisely, keep a close eye on your risk, and always be prepared for market surprises. Whether you’re into options trading, short selling, or just looking for a way to stretch your capital further, portfolio margin can offer huge advantages—if you respect its potential pitfalls.

I hope this guide has given you a clear, no-nonsense overview of portfolio margin from an everyday investor’s perspective. If you have any questions or want to share your own experiences, drop a comment below. Let’s keep the conversation going and help each other become better, more informed traders. And remember, while the mainstream might stick to vanilla approaches, smart money knows that understanding the nuances of margin can be the key to unlocking a whole new level of trading power.

For more detailed resources and broker-specific insights, check out these links: FINRA Margin Rules, Interactive Brokers Margin Information, and Schwab’s Thinkorswim Platform.

Want more insights like this delivered straight to your inbox? Subscribe to Get Joe Money Right and never miss a post! Each week, I break down investing, wealth-building, and financial strategies in a way that makes sense for everyday people like you and me. The smart money moves fast—make sure you're staying ahead of the game.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.